The

Future Of AI in Fintech

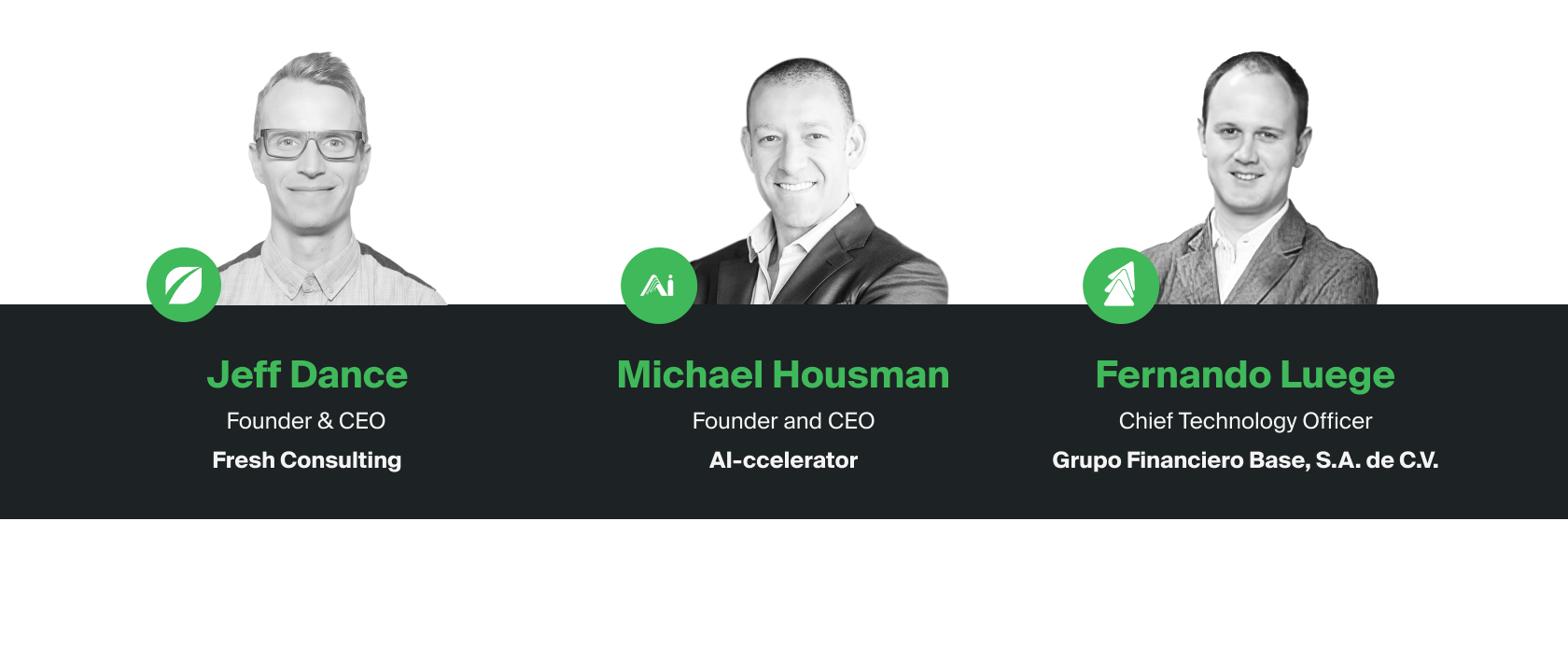

In this episode of The Future Of, Dr. Michael Housman, CEO and Founder of AI-ccelerator, and Fernando Luege, Chief Technology Officer at Grupo Financiero Base, join host Jeff Dance to discuss the future of AI in FinTech. They explore the FinTech evolution in the new AI-driven era, how generative AI unlocks new horizons in FinTech innovation, and how FinTech’s development enhances human potential.

In this episode of The Future Of, Dr. Michael Housman, CEO and Founder of AI-ccelerator, and Fernando Luege, Chief Technology Officer at Grupo Financiero Base, join host Jeff Dance to discuss the future of AI in FinTech. They explore the FinTech evolution in the new AI-driven era, how generative AI unlocks new horizons in FinTech innovation, and how FinTech’s development enhances human potential.

In this episode of The Future Of, Dr. Michael Housman, CEO and Founder of AI-ccelerator, and Fernando Luege, Chief Technology Officer at Grupo Financiero Base, join host Jeff Dance to discuss the future of AI in FinTech. They explore the FinTech evolution in the new AI-driven era, how generative AI unlocks new horizons in FinTech innovation, and how FinTech’s development enhances human potential.

The New Era of AI-Driven FinTech Innovation

The New Era of AI-Driven FinTech Innovation

FinTech encompasses technology’s intersection with financial services, including banking, insurance, and more. Currently, the landscape is in a transformative phase. Initially, sectors like payment processing, lending, and insurance saw rapid growth and innovation, leveraging sophisticated data analysis. However, the space has experienced a cooldown, shifting towards more sustainable growth and integration of AI, promising a renaissance in how data is used. This evolution signals a move from basic digitalization to a more mature phase where technologies merge and traditional financial players adopt innovative solutions.

The Unstoppable Rise of Generative AI in FinTech

With its broad applicability and accelerated adoption, generative AI will revolutionize the FinTech industry by enhancing productivity, creating innovative interfaces and products, and optimizing operational processes. The rapid development of industry-specific models enables startups and established companies to quickly leverage new technologies for consumer value. The transition to real-time, personalized advertising and product offerings, coupled with the potential of synthetic data to overcome data-sharing burdens and large language models to extract valuable insights from unstructured data, highlights generative AI’s role in driving more informed, efficient, and customer-centric financial services.

Redefining the Financial Landscape

Financial institutions and banks are only scratching the surface of AI’s potential. Institutions like HSBC are pioneering with nearly a thousand AI applications, highlighting the early stages of a much broader adoption. This exciting phase, similar to the dawn of the Internet or social media revolutions, suggests that AI will not only automate tasks but fundamentally change how financial services operate, from hyper-personalized lending to changing the essence of banking itself. Embracing AI now could redefine the future of finance, making this an ideal moment for organizations to explore how AI can enhance efficiency, personalize services, and revolutionize the industry.

The Future of Finance

Looking ahead, we’re on the brink of a transformative era in finance and technology. Michael predicts a rise in the use of various data streams for credit and lending decisions, moving beyond traditional structured data to include unstructured data from social media and the web. While this shift brings challenges, especially in fraud detection, as technologies like deep fakes become more sophisticated and accessible, it also opens doors to underbanked populations by leveraging AI to extend credit and financial services more inclusively. However, as we navigate these changes, financial institutions must adapt by prioritizing data-driven strategies and personalized customer solutions.

How Fintech’s Evolution Unlocks Human Potential

Despite the rise of AI and automation in FinTech, the future shines bright for humans. As technology takes over mundane tasks, it opens up new possibilities for financial professionals to focus on what they excel at: building relationships, enhancing customer communication, and providing strategic insights. By leveraging AI, financial institutions can streamline operations and deliver superior services, ultimately benefiting consumers with more efficient, personalized experiences.